Explore web search results related to this domain and discover relevant information.

Letter of Credit or Documentary Credit (abbreviated as "L/C") is a method that has developed into an international practice and is now widely used in…

In recent years, the General Department of Taxation (“GDT”) has instructed on imposing value-added tax (“VAT”) on L/C transaction fees arising from January 1, 2011, invoking mixed reactions from credit institutions[1].There are two conflicting views between 02 ministerial-level agencies, namely the State Bank of Vietnam (“SBV”)[2] and the Ministry of Finance (“MOF”)[3] regarding the plans of collecting VAT for L/C activities from January 1, 2011 and this discrepancy has been reported and consulted with the Prime Minister for solutions[4], whereas (i) the SBV, the Vietnam Banking Association (“VNBA”), several member credit institutions and the Banking Working Group (“BWG”) under the Vietnam Business Forum Alliance, who represent credit institutions and foreign bank branches in Vietnam all opiIn this article, we will discuss on the regulations related to L/C and analyze the nature of L/C and L/C-related operations that banks have been providing to customers, thereby determining the credit attributes of L/C; whereas other related issues such as (i) the legality and reasonableness of the collection of VAT on L/C transaction fees from January 1, 2011, (ii) VAT and the experience and approach to collecting VAT relating to L/C in some other countries, and (iii) the validity and legal value of guidance letters in Vietnam will be discussed in upcoming articles.Article 1, the Uniform Custom and Practice for Documentary Credits effective July 1, 2007 (UCP 600) of the International Chamber of Commerce (“UCP 600”) provides that the “Uniform Custom and Practice for Documentary Credits, 2007 Revision, ICC publication number 600 (“UCP”) is the rules that apply to any documentary credit (“credit”) (including standby letters of credit to the extent that these rules are applicable)”. It should be noted that UCP 600 is a set of international trade custom with a legal source status that also has been stipulated by Vietnamese law[7] and in practice it has been referenced and applied by all banks in Vietnam in relation to L/C operations[8].

Definition of Letter of credit (L/C): A document issued by the importer´s bank stating its commitment to honor a draft, or otherwise pay, on presentation of specific documents by the exporter

La Lc Le Li Ll Lo Lt · Lea Leg Les Let Lev Lex · A document issued by the importer´s bank stating its commitment to honor a draft, or otherwise pay, on presentation of specific documents by the exporter within a stated period of time. The documents the importer requires in the credit usually include, at least, a commercial invoice and clean bill of lading, but may also include a certificate of origin, inspection certificate or other documents.The most widely used type of credit in international trade is the irrevocable letter of credit, which cannot be changed or cancelled without the consent of both, the importer and the exporter. In a confirmed irrevocable letter of credit, the confirming bank adds its irrevocable commitment to pay the beneficiary (exporter).Back-to-back. A system utilized by intermediaries/brokers to finance a single transaction through the use of two L/Cs opened in succession in order to permit the intermediaries/brokers to use the proceeds from the first credit to pay off his supplier the second credit.L/C letter of credit which can be drawn against repeatedly by the beneficiary; it can take a variety of different forms depending on whether the credit is limited in terms of time, number o possible drafts, maximum quantity per draft, or maximum total quantity.

Robert Kelly is managing director of XTS Energy LLC, and has more than three decades of experience as a business executive. He is a professor of economics and has raised more than $4.5 billion in investment capital. ... Ben Woolsey is a full-time Associate Editorial Director at Investopedia, focusing on financial products and services. He has worked in marketing, operations, and content management roles for banks, credit ...

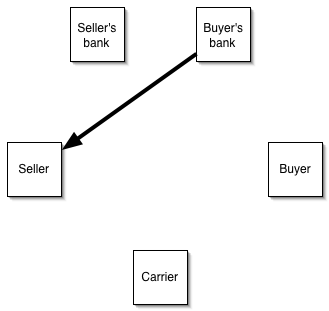

Robert Kelly is managing director of XTS Energy LLC, and has more than three decades of experience as a business executive. He is a professor of economics and has raised more than $4.5 billion in investment capital. ... Ben Woolsey is a full-time Associate Editorial Director at Investopedia, focusing on financial products and services. He has worked in marketing, operations, and content management roles for banks, credit card issuers, and credit card marketplace websites.To reduce risk, a buyer of the exporter's goods arranges a letter of credit through their bank. The bank issues the letter of credit, which guarantees payment to the exporter once the terms are met. This setup gives the exporter confidence that they'll be paid, even if the buyer defaults, because the bank backs the payment.Explore what letters of credit are, their types, costs, and real-world examples to understand their role in facilitating secure international trade.This arrangement is vital in overcoming challenges inherent in international dealings, such as differing national laws and the geographical distance between trading parties. As a result, letters of credit are indispensable in protecting both buyers and sellers from potential risks during trade.

:max_bytes(150000):strip_icc()/Term-Definitions_letterofcredit-80440d8187244f05afe53827500b72f3.png)

C'est un crédit dont la durée est supérieure à sept ans. Le crédit à long terme porte sur de fortes sommes d’argent, dont le remboursement est imposs

Crédit à long terme : kézaco ? Ymanci vous précise les termes techniques à connaître. Ymanci, courtier expert en crédit et en assurance.C’est un crédit dont la durée est supérieure à sept ans. Le crédit à long terme porte sur de fortes sommes d’argent, dont le remboursement est impossible dans un délai plus court. Dans la plupart des cas, le crédit longue durée porte sur l’achat d’un bien immobilier.Un même emprunteur peut contracter plusieurs crédits à long terme. Pour réduire ses mensualités ou financer un autre projet, il peut demander de réaliser un regroupement de crédits. Que vous ayez deux, cinq ou dix crédits, vous pouvez les fusionner pour n’avoir à payer qu’une seule mensualité.Le crédit à long terme, comme le crédit à court et moyen terme, répond à des conditions et critères d’octroi spécifiques, comme le montant emprunté, le taux d’endettement de l’emprunteur ou encore son âge en fin de prêt. Il est primordial de connaître son taux d’endettement, surtout si vous voulez vous lancer dans l’achat d’un bien immobilier.

Progressive Leasing obtains information from credit bureaus. Not all applicants are approved. © 2025 Lowe’s. Lowe’s and the Gable Mansard Design are registered trademarks of LF, LLC.

Cardmembers save more. Find the credit card tailored to your needs.Consumer Credit Financing Promotion Details: Offers are subject to credit approval. Special Financing and discount offers cannot be combined. If your purchase or order is over the minimum purchase required, you will be asked to select the offer you would like.Offer can’t be used in conjunction with or on: (i) other credit-related promotional offers; (ii) any other promotion, discount, markdown, coupon/barcode, rebate or offer, including any Lowe’s volume or special discount programs (such as but not limited to, Contractor Pack, Buy in Bulk, Value Savings Program (“VSP”), Special Value, New Lower Price, Was:Now, Military Discount, Employee Discount, and Lowest Price Guarantee); (iii) associate discretion price adjustments; (iv) any services (such as but not limited to, rentals; extended protection/replacement plans; shipping, delivery, assembly or installation fees); (v) fees or taxes; (vi) previous sales; (vii) gift cards; or (viii) Weber, Kichler, or Miele products.Offer can’t be used in conjunction with or on: (i) 5% Off Every Day offer or any other credit-related discount offer; however, if the 5% Off Every Day discount offer is greater than $100, the greater discount will automatically be applied; (ii) any other promotion, discount, markdown, coupon/barcode, rebate or offer, including any Lowe’s volume or special discount programs (such as but not limited to, Contractor Pack, Buy in Bulk, Value Savings Program (“VSP”), Special Value, New Lower Price, Was: Now, Military Discount, Employee Discount, & Lowest Price Guarantee); (iii) associate discretion price adjustments; (iv) any services (such as but not limited to, rentals; extended protection/replacement plans; shipping, delivery, assembly or installation fees); (v) fees or taxes; (vi) previous sales; (vii) gift cards; or (viii) Weber, Kichler, or Miele products.

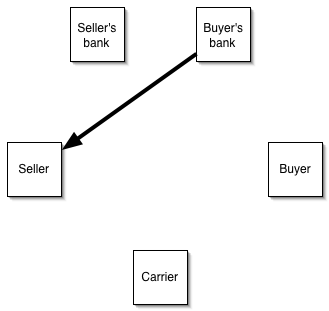

A line of credit is a credit product that banks and other financial institutions offer their customers. They are available for both personal customers and business clients. Like other credit products, customers must qualify to be approved for a line of credit.

A line of credit (LOC) is a preset borrowing limit offered by banks and financial institutions to their personal and business customers. Lines of credit can be used at any time until the limit is reached. The limit is set by the issuer based on the borrower's creditworthiness.A line of credit is a credit product that banks and other financial institutions offer their customers. They are available for both personal customers and business clients. Like other credit products, customers must qualify to be approved for a line of credit.The LOC is highly flexibility, which is its main advantage. Borrowers can request a certain amount, but they do not have to use it all. Rather, they can tailor their spending from the LOC to their needs and owe interest only on the amount that they draw, not on the entire credit line.Most LOCs are unsecured loans. This means that the borrower does not promise the lender any collateral to back the LOC. One notable exception is a home equity line of credit (HELOC), which is secured by the equity in the borrower’s home.

:max_bytes(150000):strip_icc()/LOC-13d791780aa54b6a9a28120d6d1c9f65.jpg)

Only 1 credit related promotional offer can be applied to any one item on a sales receipt. The “purchase date” for an item is the date it is charged to your account. Your account will be charged immediately for an item, unless otherwise provided on your order sales receipt.

© 2025 Lowe’s. Lowe’s and Gable Mansard Design are registered trademarks of LF, LLC.CREDIT FINANCING PROMOTION DETAILS: Offers subject to credit approval. Special Financing & discount offers can’t be combined. If your purchase or order is over the minimum purchase required, you will be asked to select the offer you would like. We reserve the right to discontinue or alter the terms of these offers any time.Offer can’t be used in conjunction with or on: (i) other credit-related promotional offers; (ii) any other promotion, discount, markdown, coupon/barcode, rebate or offer, including any Lowe’s volume or special discount programs (such as but not limited to, Contractor Pack, Buy in Bulk, Value Savings Program (“VSP”), Special Value, New Lower Price, Was: Now, Military Discount, Employee Discount, and Lowest Price Guarantee); (iii) associate discretion price adjustments; (iv) any services (such as but not limited to, rentals; extended protection/replacement plans; shipping, delivery, assembly or installation fees); (v) fees or taxes; (vi) previous sales; (vii) gift cards; or (viii) Weber, Kichler or Miele products.Only 1 credit related promotional offer can be applied to any one item on a sales receipt. The “purchase date” for an item is the date it is charged to your account. Your account will be charged immediately for an item, unless otherwise provided on your order sales receipt.

A line of credit allows you to borrow money up to a preset limit. Learn about how it works.

Learn more about different kinds of credit lines, how they work and how they could affect your credit scores. What you’ll learn: Lines of credit are typically revolving accounts, which work similarly to credit cards. But there are some nonrevolving lines of credit.Lines of credit are types of loans borrowers can use and then repay again and again up to a preset limit or pay off a set amount over time, at which point the account is usually closed. Lines of credit are typically available at financial institutions such as banks and credit unions.Generally, a line of credit has a set credit limit. The account holder can borrow and repay money up to that limit. Lenders typically set the credit limit based on the borrower’s creditworthiness. Lines of credit also usually charge interest, at either a fixed or a variable rate.A line of credit is a type of account that allows a borrower to withdraw money and repay it over and over again as long as the account is open and in good standing.

A lender credit is money your lender gives you to offset some (or all) of your closing costs. In return, you agree to a slightly higher mortgage interest rate. It’s a trade-off — you’ll pay less upfront, but more over time through higher monthly payments.

Lender credits allow borrowers to reduce their upfront closing costs, often used in a no-closing-cost mortgage. In exchange, the lender charges a higher mortgage rate — this means you’ll pay less at closing, but more over the life of your loan.The example below shows how a lender credit might affect both your closing costs and monthly mortgage payments if you were to take out a $450,000 loan with a 20% down payment and owe $13,500 in closing costs. We’ll assume that your lender will apply 2% of your loan amount ($9,000) toward closing costs for every quarter-percentage-point increase in your interest rate.Lender credits reduce or eliminate upfront closing costs, which can make buying a home more affordable. Frees up money at closing. By paying lower upfront costs, you can keep more cash on hand for moving expenses, savings or emergency funds. Increases flexibility in your home search. Since you’ll pay less in upfront costs, you’ll potentially have a larger house budget.Increases your interest costs. Opting for lender credits means accepting a higher interest rate, which increases your long-term borrowing costs. · Results in higher monthly mortgage payments. You’ll pay more each month due to the higher interest rate.

A Letter of Credit (L/C) is payment arrangement used typically in International Trade. The issuing bank guarantees that an exporter will receive payment

A Letter of Credit (L/C) is payment arrangement used typically in International Trade. The issuing bank guarantees that an exporter will receive payment in full as long as certain delivery conditions have been met. In a Standby Letter of Credit, if the importer is unable to make a payment on the purchase, the bank will cover the outstanding amount.What is the definition of Letter of Credit (L/C) along with it's audio definition and pronunciations. Find out here and other financial terms.A Letter of Credit (L/C) is typically more expensive than Cash Against Documents funding but offers more safety and control.

A letter of credit (LC), also known as a documentary credit or bankers commercial credit, or letter of undertaking (LoU), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Letters of credit are used extensively ...

A letter of credit (LC), also known as a documentary credit or bankers commercial credit, or letter of undertaking (LoU), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Letters of credit are used extensively in the financing of international trade, when the reliability of contracting parties cannot be readily and easily determined.Typically, after a sales contract has been negotiated, and the buyer and seller have agreed that a letter of credit will be used as the method of payment, the applicant will contact a bank to ask for a letter of credit to be issued. Once the issuing bank has assessed the buyer's credit risk, it will issue the letter of credit, meaning that it will provide a promise to pay the seller upon presentation of certain documents.Once the beneficiary (the seller) receives the letter of credit, it will check the terms to ensure that it matches with the contract and will either arrange for shipment of the goods or ask for an amendment to the letter of credit so that it meets with the terms of the contract.Once the goods have been shipped, the beneficiary will present the requested documents to the nominated bank. This bank will check the documents, and if they comply with the terms of the letter of credit, the issuing bank is bound to honor the terms of the letter of credit by paying the beneficiary.If the documents do not comply with the terms of the letter of credit they are considered discrepant. At this point, the nominated bank will inform the beneficiary of the discrepancy and offer a number of options depending on the circumstances after consent of applicant.

A Letter of Credit is a contractual commitment by the foreign buyer’s bank to pay once the exporter ships the goods and presents the required documentation.

A Letter of Credit is a contractual commitment by the foreign buyer’s bank to pay once the exporter ships the goods and presents the required documentation to the exporter’s bank as proof.When possible, offering extended payment terms can be extremely attractive to new foreign buyers and may ultimately lead to winning more export sales. However, to offer this sought-after benefit, you must check the foreign buyer’s credit which is not always easy to find.They are recommended for use in higher-risk situations, when the importer’s credit is unacceptable or not available, when dealing with a new or less-established trade relationship or when extended payment terms are requested.Grow your export sales by offering extended payment terms to your foreign buyers with a Letter of Credit.

When it comes to making education more accessible, the Lifetime Learning Credit (LLC) is a valuable tax credit that offers financial relief for education expenses. Whether you're pursuing a degree, upgrading your skills, or simply exploring a new area of knowledge, the LLC provides an opportunity ...

When it comes to making education more accessible, the Lifetime Learning Credit (LLC) is a valuable tax credit that offers financial relief for education expenses. Whether you're pursuing a degree, upgrading your skills, or simply exploring a new area of knowledge, the LLC provides an opportunity to reduce the cost of learning.Taxpayers can claim 20% of the first $10,000 in qualified educational expenses, allowing for a maximum credit of $2,000 annually. Unlike some education-related tax credits, the LLC is highly flexible, covering a wide range of educational activities, from degree programs to non-degree courses aimed at skill-building or personal enrichment.Education is an investment in your future, but it often comes with a hefty price tag. The LLC helps to alleviate this financial burden by allowing taxpayers to offset their education costs with a dollar-for-dollar reduction in their tax liability. The flexibility of the credit makes it ideal for lifelong learners.Unlike the American Opportunity Tax Credit (AOTC), which is limited to undergraduate education, the LLC supports various types of learning, including graduate studies, professional certifications, and even courses that enhance your career skills.

A Letter of Credit (LC) is a financial instrument widely used in international trade transactions. It represents a written commitment from a bank, on behalf

A Letter of Credit (LC) is a financial instrument widely used in international trade transactions. It represents a written commitment from a bank, on behalf of the buyer (importer), to pay the seller (exporter) a specified amount of money under specific conditions.Cross-Border Complexity: Dealing with different legal systems, currencies, and regulatory environments in cross-border transactions introduces complexity and uncertainty. Letter of Credit provides a standardized and widely accepted framework to navigate these complexities.In summary, a Letter of Credit (LC) is a pivotal financial instrument in international trade, providing a secure and standardized mechanism for payment. Its significance lies in offering financial security, building trust in cross-border transactions, and standardizing terms and conditions.Risk Mitigation: Letter of Credit plays a crucial role in mitigating risks for both buyers and sellers.

RATES ARE BASED ON THE REPRESENTATIVE CREDIT SCORE AND LTV.

A letter of credit is vital for anyone involved in international business. Find out how this simple instrument can make all the difference inside.

A letter of credit is a document that a bank can issue to a manufacturer or other large seller of goods to guarantee that a buyer is able to pay their bill on time. It is common in international trade, where it can be difficult to quickly move money from one bank to another.For example, if Bob is ordering widgets from a company in Japan for the first time, he might send a letter of credit with his order, knowing it can take a few days (or longer) for his actual payment to appear in the company's accounts.If something goes wrong and the payment doesn't show up, or Bob ends up in bigger financial trouble than he could imagine at the time of sending the letter of credit, another party -- often his own bank -- will cover the cost to the Japanese company so that the seller isn't out anything from its good faith delivery of merchandise.A letter of credit guarantees payment to sellers in international trade.

LM Credit is your partner. We are credit experts not brokers and we speak with you using terms you’ll understand instead of confusing jargon.

Michael’s illness left him owing over $17,000 to various credit companies. See how LM Credit helped him rehabilitate his credit score to get back to banking.We want to make it easier to elevate your credit and get you back on track.

There are no origination fees or ... your credit score. Our award-winning checking and savings products work as hard for your money as you do. Whether it's our rewards-earning ... CDs, we help you take your finances to the next level. Get customized loan options based on what you tell us. Select the rate, term, and payment options you like best. Once your loan is approved for funding, we’ll pay your creditors ...

There are no origination fees or prepayment penalties with LendingClub auto loan refinancing, and checking your rate will not impact your credit score. Our award-winning checking and savings products work as hard for your money as you do. Whether it's our rewards-earning ... CDs, we help you take your finances to the next level. Get customized loan options based on what you tell us. Select the rate, term, and payment options you like best. Once your loan is approved for funding, we’ll pay your creditors directly or send the money in as little as 24 hours1.The best APR discounts are available to borrowers with excellent credit. Advertised discounted rates are subject to change without notice. Standard data and message rates may apply to Mobile Banking services. This includes the use of LendingClub Mobile, LendingClub Commercial, and other services. Android is a trademark of Google LLC.Once your loan is approved for funding, we’ll pay your creditors directly or send the money in as little as 24 hours1.Check Your RateWe’re rewriting the rules of traditional banking, and we only win when our customers succeed. We’ve helped over 4 million members reach their goals, and we’re just getting started!

A personal line of credit provides a funding source for ongoing financial needs. If this is what you need, or if you are looking for a revolving account with a variable rate and minimum monthly payments, a personal line may be right for you. ... In most cases you’ll need a FICO credit score ...

A loan or line of credit may be right for you. ... Get the car you want whether it’s from a family member, a friend or social marketplace. You may just drive away with a better deal. ... We have lending consultants who can help. Learn about your loan options and get personalized estimates for your situation. Give us your details and we’ll give you a call.Loan approval is subject to eligibility and credit approval. Refer to Your Deposit Account Agreement (PDF) and the Consumer Pricing Information (PDF) disclosure for a summary of fees, terms and conditions that apply. ... To check your rate, we’ll ask for some information about you to do a soft credit check (which won’t affect your credit score).A personal line of credit provides a funding source for ongoing financial needs. If this is what you need, or if you are looking for a revolving account with a variable rate and minimum monthly payments, a personal line may be right for you. ... In most cases you’ll need a FICO credit score of 680 or above.Protect your U.S. Bank checking account from overdrafts with a reserve line of credit. You’ll enjoy no annual fee and automatic advances to your checking account if your balance ever falls below zero.

Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost®. Learn more.See disclosures ... As your BFF, we’ll help you manage your money on the go, send real-time credit alerts straight to your phone, and a lot more.

Experian is committed to helping you protect, understand, and improve your credit. Start with your free Experian credit report and FICO® score.Approval of your application will result in a hard inquiry, even if you’re unable to pass final verifications, which may impact your credit scores.Introducing the digital checking account designed by credit experts. You could raise your credit scores just for paying bills like rent, internet and utilitiesø.Manage your credit basics with these free tools.

:max_bytes(150000):strip_icc()/Term-Definitions_letterofcredit-80440d8187244f05afe53827500b72f3.png)

:max_bytes(150000):strip_icc()/LOC-13d791780aa54b6a9a28120d6d1c9f65.jpg)